Are you planning a loan for a house move in Dubai or the UAE, a dream vacation, or a major financial goal? Easily estimate your monthly installment (EMI) and feel in full control of your finances with the Emirates NBD Personal Loan Calculator. As the UAE’s most trusted financial institution, Emirates NBD offers you fast loan facilities with an easy application process that includes age 21 to 60, a minimum income of AED 5,000, and other qualifying conditions.

Whether you are employed or self-employed, our expertly designed calculator gives you an accurate estimate with a 1.05% loan processing fee, a tenor of up to 4 years, and transparent terms. Enter your details today, get an instant quote, and make your dreams a reality with Emirates NBD. We have provided the NBD calculator below that you can use free of charge.

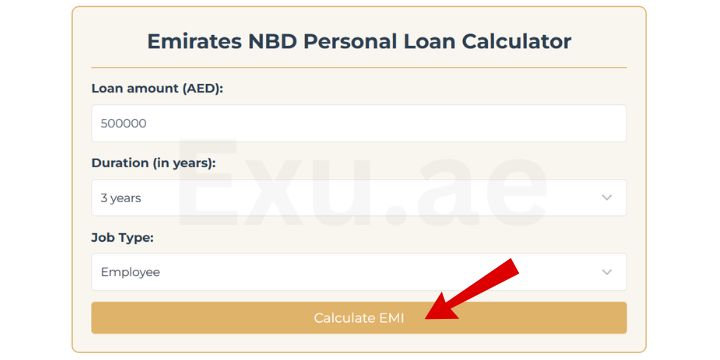

Emirates NBD Personal Loan Calculator

Emirates NBD Loan Details

| UAE Gratuity Calculator | UAE Taxi Fare Calculator |

| ADCB Car Loan Calculator | NBD Personal Loan Calculator |

| UAE Zakat Calculator | UAE Budget Planner |

| Gold Zakat Calculator | Qurtoba GPA Calculator |

How to Use a Personal Loan Calculator?

Our calculator is designed after following the information of Emirates NBD Bank. We have tried our best to ensure that there is no mistake in it. If you do not know how to use the calculator, then follow the information given below and use the calculator.

If you have to use the calculator and want to apply for a loan after getting your result, then click on the yellow button below to Apply for Emirates NBD Personal Loan.

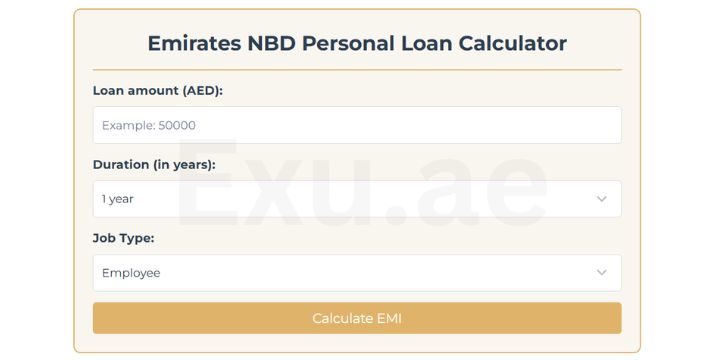

Step 1: Access the calculator

First, find the Emirates NBD Personal Loan Calculator box on the webpage. It will be a box with a prominent yellow border the bank’s logo and a clear heading. If you are on a mobile phone, it will automatically adjust to your screen.

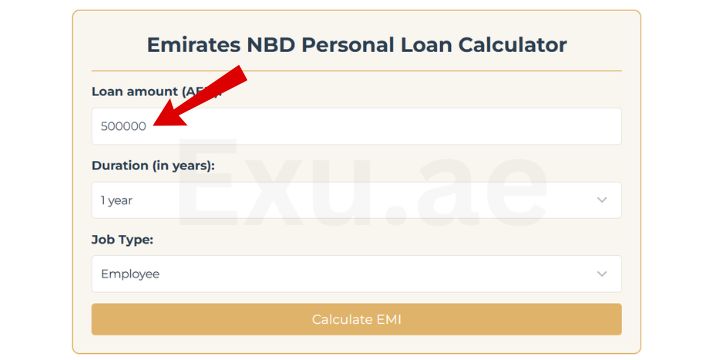

Step 2: Enter the loan amount

Enter your desired amount in the Loan Amount (AED) box. For example, if you want to borrow 50,000 AED, type 50,000 here.

Note: The minimum amount is AED 5,000. The calculator will warn you if you enter less than 5,000.

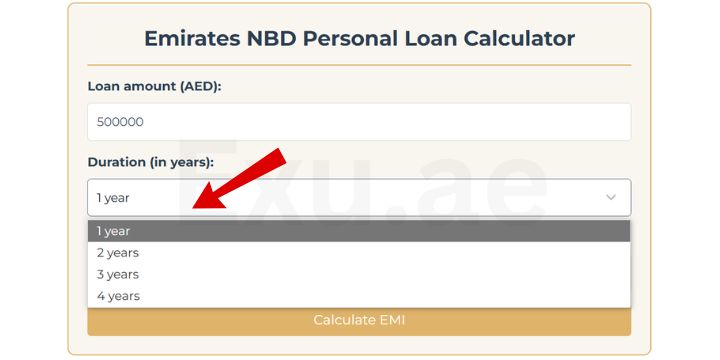

Step 3: Select the term

Select the loan repayment period from the Term (in years) drop-down menu. You can choose from options ranging from 1 year to 4 years.

Example: If you want to borrow a 3-year loan, select the 3-year option. The maximum tenure for self-employed customers is 4 years.

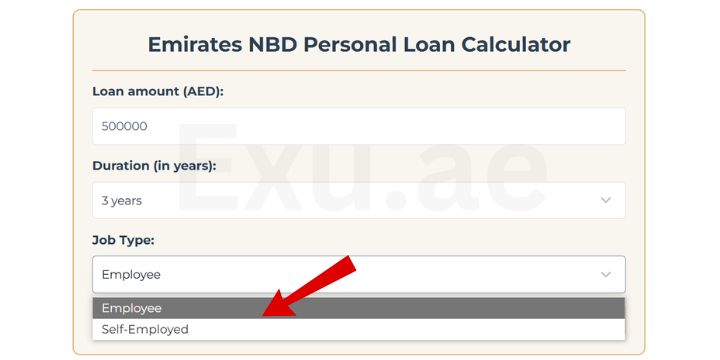

Step 4: Select Job Type

In the Job Type drop-down, select the option according to your status:

- Employee: If you work for a company.

- Self-employed: If you are a business owner or freelancer.

Note: Interest rates may be slightly higher for self-employed customers.

Step 5: Estimate EMI

After entering all the information, click on the yellow Estimate EMI button. This button will show you the following details in a new pop-up window:

- Your Monthly Installment (EMI)

- Total Processing Fee (500 AED to 2,500 AED + VAT)

- Total Cost of Loan (EMI x Tenure + Fees)

Step 6: Understand the Results

Read the results displayed in the pop-up carefully:

- EMI: This is the amount you will have to repay to the bank every month.

- Processing Fee: This fee is deducted at the time of loan approval.

- Total Amount Paid: Principal + Interest + Fees.

Important Notes

This calculator provides an estimate only. Final terms will depend on the application being approved by the bank. Self-employed customers are required to show a 6-month 50,000 AED bank balance.

EMI is calculated based on an annual interest rate of 8.5% to 9.5% (depending on the type of employment).

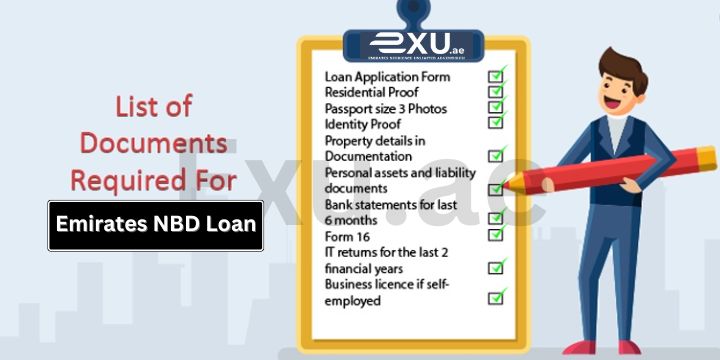

NBD Personal Loan Apply Documents required

Salaried applicants must work for a company on Emirates NBD’s approved employer list. Self-employed business must be running with continuous cash flow for 2+ years. Processing time will take 24-48 hours if all documents are submitted correctly.

All documents must be valid for at least 3 months from the application date Check the list of additional documents below:

| Document | Salaried Applicants | Self-Employed | Notes |

|---|---|---|---|

| Passport | ✓ Original + Copy | ✓ Original + Copy | Must be valid. |

| UAE Residency Visa | ✓ Copy | ✓ Copy | Must be valid. |

| Emirates ID | ✓ Original + Copy | ✓ Original + Copy | Must be valid. |

| Staff ID/Labor Card/Work ID | ✓ Copy | ✗ | Proof of employment. |

| Latest Salary Certificate | ✓ Original | ✗ | Issued by employer (Arabic/English). |

| Personal Bank Statements | ✓ Last 3 Months | ✓ Last 6 Months | Must show salary credits (AED 5,000+ monthly). |

| Security Cheque | ✓ | ✓ | Signed blank cheque for loan security. |

| Business Trade License | ✗ | ✓ Copy | Valid for 2+ years (for self-employed). |

| Business Bank Statements | ✗ | ✓ Last 6 Months | Minimum AED 50,000 average balance (for self-employed). |

| Additional Documents | As requested | As requested | The bank may request more documents during processing (e.g., tenancy contract). |

For instant assistance, visit an Emirates NBD branch or call 800 3623.

FAQs

No, this calculator gives you an initial estimate. The final EMI is determined by the bank after checking your income, credit score, and employment history. However, our tool provides up to 90% accurate results.

Not! You will need to submit documents such as a passport, salary certificate, and bank statement to complete your application. See the Documents required section above for a full list.

1) Employee: Minimum 5,000 AED monthly salary + Company must be on the bank’s approved list.

2) Self-Employed: 2 years old business + 6 months bank balance of 50,000 AED.

In such cases, Emirates NBD’s Loan Expert team will offer you alternative solutions (such as a lower amount or longer term). For immediate assistance, call 800 3623.

Conclusion

Emirates NBD Personal Loan Calculator is the first step to making your financial plans a reality. Whether you’re renovating your home, paying for your children’s education, or planning a beautiful vacation, our calculator gives you a clear financial roadmap. Take action today:

- Check UAE Zakat Calculator 2025.

- Click here to apply online.

- Contact the NBD loan support team at 800 3623 for any questions.

Get approval in 24 hours, minimal paperwork, and free expert guidance with Emirates NBD. Start your journey to financial freedom today!

(Note: Emirates NBD reserves the right to change all terms and rates.)